How blockchain is transforming access to one of humanity’s oldest asset classes

Gold’s Timeless Role, Its Modern Challenges

“Gold is one of the few assets in the world that has never gone to zero.” - Adam Bouktila

Gold has served as a universal store of value for thousands of years. Across civilizations and economic systems, it has remained one of the few assets that everyone understands, trusts, and values. Recently, RWA.io Co-founder and CSO Adam Bouktila sat down with CMO Sebastiaan Opschoor to discuss the importance of this marvelous metal.

In this in-depth discussion, Adam breaks down the real bottlenecks, opportunities, and why gold matters more than ever.

Even in today’s digital, hyper-connected financial world, gold still matters. It protects wealth against currency volatility, inflation, and geopolitical uncertainty. Many communities in emerging markets continue to store generations of savings in gold jewelry or bars because their local currencies are too unstable.

However, owning gold physically comes with real challenges:

- Buying gold is expensive, especially in small amounts

- Storing it safely is difficult and costly

- Transporting it across borders is risky

- Fractionalizing it (e.g., gifting small amounts) is nearly impossible

These limitations are a barrier for everyday people who want simple, safe ways to save.

Tokenization is changing that.

By transforming gold into digital tokens backed 1:1 by real, audited bullion, blockchain technology makes gold:

- More accessible — smaller amounts become available

- More secure — stored by audited, insured custodians

- More transparent — with on-chain proof-of-reserves

- More functional — usable in DeFi as collateral or liquidity

- More globally available — transferable across borders in minutes

These are the core ideas this article explores: how tokenized gold solves old problems, unlocks new opportunities, and helps democratize access to one of the world’s most trusted assets.

What Is Gold Tokenization?

Gold tokenization is the process of converting physical gold into blockchain-based tokens. Each token represents a specific unit of real gold typically 1 gram or 1 troy ounce, held in secure vaults by regulated custodians. As Adam stated,

“Having something on a blockchain, with smart contracts behind it, means you can verify the custodian and see the proof-of-reserves.”

Tokenization provides transparency-enhancing features such as:

- Smart contracts

- Proof-of-reserves

- Public audit trails

- Verifiable mint and redemption events

In short: tokenized gold doesn’t change what gold is, but, it does changes how we access and use it.

Why Tokenize Gold? Key Benefits

Tokenized gold brings meaningful benefits to everyday consumers, global savers, long-term investors, and Web3 participants. As summed up by Adam:

“It’s becoming increasingly hard to buy physical gold in small amounts as the price goes up; tokenized gold solves that problem instantly.”

Fractional Ownership

Physical gold has a high entry price. Tokenization makes it accessible.

- Buy small amounts instantly

- Allows micro-savings and long-term accumulation

- Accessible to younger investors and emerging markets

$20 can now buy a meaningful amount of gold, previously impossible with bullion.

Storage, Security & Global Liquidity

“Tokenized gold is transportable. You can fractionalize it, move it, and actually use it.” - Adam Bouktila

Owning gold traditionally means paying for secure vaults, dealing with insurance, or taking on the personal risk of storing it at home. Tokenized gold removes these friction points entirely by shifting storage to regulated, insured custodians. Users retain full ownership of the underlying asset, but without the logistical concerns that accompany physical bullion.

Beyond secure storage, tokenized gold unlocks a level of liquidity and portability that physical gold simply cannot match. Secure storage is essential, but it’s the liquidity and mobility unlocked by tokenization that truly transforms gold from a static asset into a globally usable digital tool.

And due to the fact that tokenized gold exists on public blockchains:

- It’s tradable 24/7:

You can buy or sell tokenized gold at any time, no market hours, intermediaries, or delays. Trades settle at blockchain speed, giving users continuous access to liquidity. - It’s transferable across borders in minutes:

Moving physical gold internationally is slow, costly, and complex. Conversely, tokenized gold, by contrast, can be sent anywhere in the world with just a wallet address, no customs forms, couriers, or physical transport required. - It’s accessible globally:

Anyone with an internet connection can own tokenized gold, regardless of geography or financial infrastructure. This opens powerful opportunities for a considerable portion of savers in emerging markets, unbanked populations, and regions with unstable currencies to store value in a resilient, historically proven asset.

Together, these features make tokenized gold not only safer to store but to attain, trade and transport, bringing the benefits of gold ownership to a global, digital audience. This is especially important in countries where bank access is limited, but smartphone penetration is high

Utility in DeFi & Web3

“You can now put your gold to work, lock it in liquidity pools, earn fees, or borrow against it.” Adam Bouktila

In Web3, gold becomes much more productive.

- Use it as collateral

- Borrow against it without selling

- Earn yield in liquidity pools

- Rebalance portfolios seamlessly

For many users, this is the first time gold provides both protection and yield.

Transparency & Verification

Tokenized gold offers higher transparency than most ETFs or paper gold products:

- On-chain proof-of-reserves

- Verifiable custodians

- Transparent issuance and redemption

- Immutable audit trails

This builds user trust while maintaining regulatory-friendly structure and oversight.

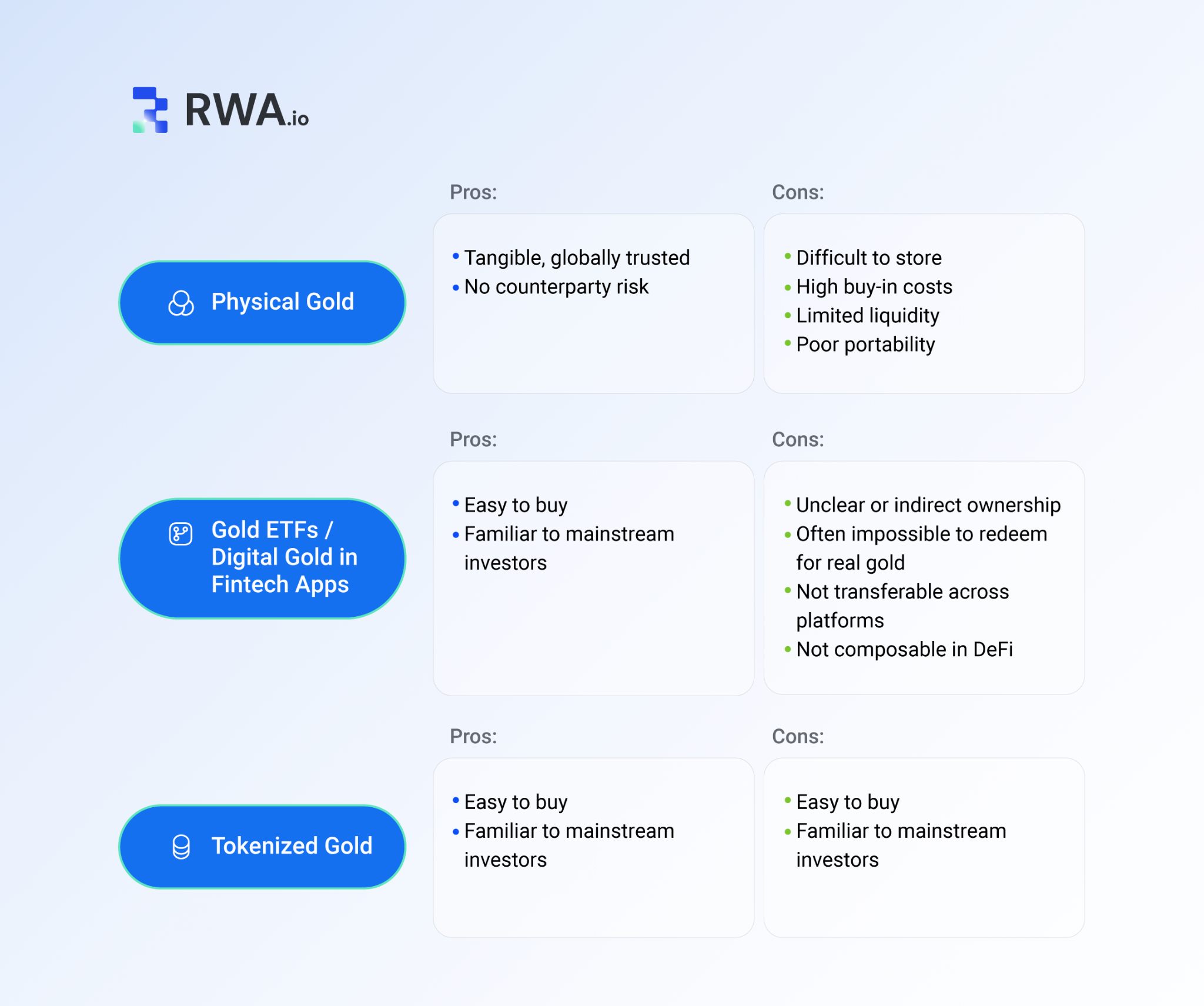

Tokenized Gold vs. ETFs vs. Physical Gold

Adam highlighted many of the limitations of traditional gold investment vehicles come down to a single issue: true ownership.

“The real problem with ETFs and paper gold is ownership. Can you send it? Can you self-custody it? Can you even withdraw it?”

This question highlights the practical constraints that physical gold and ETFs still impose on everyday investors. Tokenized gold approaches these challenges differently. Here’s how it compares across traditional and digital formats:

The Market Today: Leaders & Adoption Trends

Tokenized gold is gaining momentum, supported by stronger infrastructure, broader exchange availability, and rising global interest in hard-asset savings. As Adam noted during the interview:

“Tether Gold is around $2 billion, compared to hundreds of billions in USDT. It’s still a small market, but it’s growing fast.”

This perspective captures both sides of the current landscape: tokenized gold is still early, yet its growth is accelerating with real traction across exchanges and user segments.

- PAX Gold (PAXG)

- Tether Gold (XAUT)

According to trends highlighted in the interview:

- The market has nearly doubled in volume/value year-over-year

- XAUT alone is approaching $2 billion in market cap

- Tokenized gold is expanding across major CEXs like Bybit and OKX

- Growing interest comes from both crypto traders and savers in volatile economies

Tokenized gold is not replacing stablecoins, but it is increasingly used as a complementary store of value.

Real-World Use Cases

These aren’t hypothetical scenarios; tokenized gold is already being used in practical, meaningful ways across different parts of the world. RWA platforms are serving users across the financial spectrum, from global savers to advanced DeFi participants.

Savings in Emerging Markets

In countries with unstable currencies, tokenized gold allows:

- Micro-savings

- Inflation protection

- Non-correlated, global-value storage

- Dollar-cost averaging as low as $5–$10 per month

For many communities, this creates a more stable and dignified path to financial security.

Portfolio Diversification

Tokenized gold provides stability during crypto volatility:

- Hedge against downturns

- Rebalance instantly on-chain

- Store wealth in a historically resilient asset

Cross-Border Transfers

Moving physical gold internationally is expensive and risky. Tokenized gold removes this friction:

- Instant transfers

- Low fees

- No travel or customs issues

Collateralized Borrowing

Tokenized gold can unlock liquidity through borrowing without requiring a sale, often not a taxable event and highly capital-efficient.

Borrowers can:

- Borrow stablecoins

- Use gold as collateral

- Maintain ongoing exposure to gold’s price movements

Risks & Considerations

As Adam cautioned during the discussion, even with all the benefits tokenized gold offers, responsible participation requires understanding the risks:

“Locking tokenized gold into a smart contract always carries risk and people need to do their own research.”

Tokenized gold is a powerful, innovative tool—but like any asset that bridges traditional finance and blockchain, it is not without vulnerabilities. Users should carefully consider:

- Smart contract risk

- Custodian risk (who holds the gold?)

- Platform risk (CEXs, DEXs, lending markets)

- Regulatory considerations

- The importance of choosing established issuers

As with any financial product, responsible research and exploration is essential.

The Path to Mass Adoption

As Adam explained during the interview, tokenized gold is finding its place within the broader digital asset ecosystem, not as a replacement for stablecoins, but as a complementary long-term value asset:

“Tokenized gold won’t replace fiat-backed stablecoins, but it will become an important way for people to save and protect value.”

This distinction is important. Stablecoins serve as units of account and transactional tools, while gold, tokenized or not, remains a store of value. For tokenized gold to reach mainstream global adoption, several developments need to mature:

- More intuitive user experiences

- Better wallet-less onboarding

- Integration into neobanks and mainstream fintech apps

- Wider educational initiatives

- Clear regulatory frameworks

Still, the trajectory is undeniably strong.

Gold’s role endures, and tokenization simply expands who can access it, how easily, and with what freedoms. As these pieces fall into place, tokenized gold has the potential to bring secure, inflation-resistant savings to millions of people who have never had access to such financial tools.

How RWA.io Helps You Explore Tokenized Gold

RWA.io is the leading research hub for tokenized real-world assets, including gold.

On RWA.io, users can:

- Explore top tokenized gold assets

- Compare issuers, reserves, custodians, and market caps

- Review transparency metrics and proof-of-reserves

- Analyze liquidity across exchanges

- Track performance trends

- Discover lending opportunities and integrations

- Make informed choices with confidence

The platform empowers users to research responsibly with data, tools, and transparency. As an analytics platform, RWA.io allows users to make confident, independent decisions.

Conclusion

Tokenized gold represents the next evolution of an asset that has shaped global finance for millennia. By combining the timeless reliability of gold with the speed, transparency, and accessibility of blockchain, tokenization unlocks a more inclusive financial future.

It allows anyone, whether a seasoned investor, a saver in an emerging economy, or a newcomer to Web3, to access gold safely, affordably, and in meaningful increments. It opens the door to new opportunities: lending, yield, global transfers, and portfolio diversification. And it does so while reinforcing trust through transparent, verifiable, on-chain systems.

Gold isn’t changing. But the way we interact with it is.

Tokenization brings gold into the digital age, more accessible, more portable, and more empowering than ever before. Platforms like RWA.io are helping users explore this new landscape with clarity, confidence, and data-driven insights.

When it comes to protecting value, building wealth, or creating long-term financial resilience, tokenized gold is quickly becoming a modern essential. And as Adam reminded us at the start of this conversation, “Gold is one of the few assets in the world that has never gone to zero.” Tokenization simply makes that stability more accessible than ever.